叫我如何不宰你_连载_读书_腾讯网:

MUST Read!

Period!

Friday, 27 April 2012

Thursday, 26 April 2012

Celebrities (business or just fame) need to take personal responsibilities with recommendations/suggestions they made!! Why Bill Gates Is A Hero And Donald Trump Is A Zero - Forbes

Why Bill Gates Is A Hero And Donald Trump Is A Zero - Forbes:

IMHO, any celebrities (business or just fame) should take personal responsibilities for comments/suggestions they made.. so they will be careful of what they say or recommend.. especially given this type of life and death situation!!

suggest you all read...

IMHO, any celebrities (business or just fame) should take personal responsibilities for comments/suggestions they made.. so they will be careful of what they say or recommend.. especially given this type of life and death situation!!

suggest you all read...

Wednesday, 25 April 2012

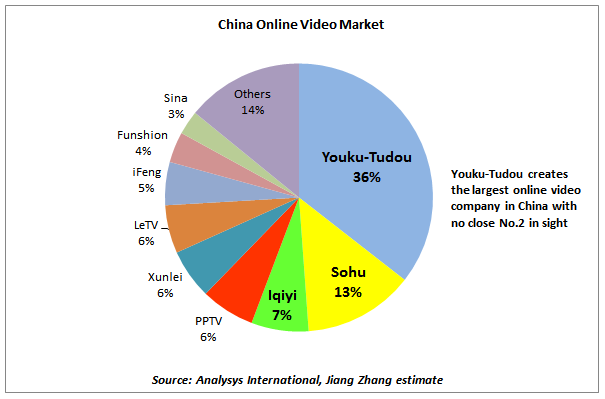

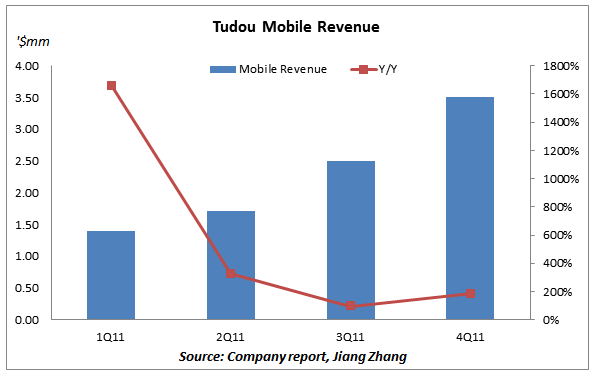

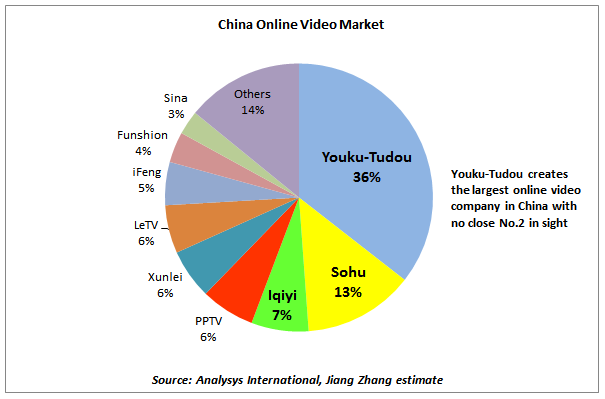

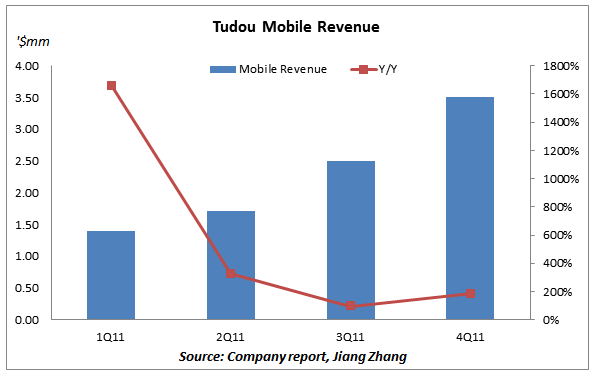

Nice graph but don't trade based on this article. Youku-Tudou: A Potent Force In China's Online Video Market - Seeking Alpha

Youku-Tudou: A Potent Force In China's Online Video Market - Seeking Alpha:

good read. but don't suggest you 'trade' based on this article..

good graph also:

good read. but don't suggest you 'trade' based on this article..

good graph also:

Tuesday, 24 April 2012

a Very thought provoking speech X X V T H WORLD TR ADERS’ TACITUS LECTURE by Terry Smith Chief Executive, Tullett Prebon PLC & Fundsmith LLP, Is ‘Occupy’ Right?

It is very much worth your time to read the above brilliant speech 'in full'..

Recommended! Also check out his presentation to shareholders (also sounds like a sales pitch in part..) but worth a watch, brilliant for his honesty & application of common sense.. our UK version of Warren Buffet in the making (maybe prefer colgate than cherry coke!)

Recommended! Also check out his presentation to shareholders (also sounds like a sales pitch in part..) but worth a watch, brilliant for his honesty & application of common sense.. our UK version of Warren Buffet in the making (maybe prefer colgate than cherry coke!)

Monday, 23 April 2012

Great speech & Must read: Tomorrow's Value lecture by Gervais Williams: Why a bird in the hand is really worth two in the bush

forceforgood Resources - Article - Tomorrow's Value lecture by Gervais Williams: Why a bird in the hand is really worth two in the bush:

Brilliant lecture! Must read if you have missed it. click through the link above.

"Tomorrow's Value lecture by Gervais Williams: Why a bird in the hand is really worth two in the bush"

forceforgood Resources - Article - Tomorrow's Value lecture by Gervais Williams: Why a bird in the hand is really worth two in the bush:

Brilliant lecture! Must read if you have missed it. click through the link above.

"Tomorrow's Value lecture by Gervais Williams: Why a bird in the hand is really worth two in the bush"

forceforgood Resources - Article - Tomorrow's Value lecture by Gervais Williams: Why a bird in the hand is really worth two in the bush:

Wednesday, 18 April 2012

"MUST Watch", Lord Stephen Green's lecture (UK Minister, ex Chairman HSBC) on Values and Value in the Marketplace | Gresham College

Values and Value in the Marketplace | Gresham College:

MUST watch.. Lord Green knows what he is talking about! and this is A LOT of food for thought!

not sure if my insightful question was included though! ;-)

I will re-watch it very soon.

Great work by the little know but well respected: http://www.gresham.ac.uk

MUST watch.. Lord Green knows what he is talking about! and this is A LOT of food for thought!

not sure if my insightful question was included though! ;-)

I will re-watch it very soon.

Great work by the little know but well respected: http://www.gresham.ac.uk

His book

Good Value: Reflections on Money, Morality and an Uncertain World [Hardcover]

My comments to: NYU's Aswath Damodaran: Why I Dumped All My Shares Of Apple - Business Insider

Sorry guys, please don't be the 'taxi driver' follower investor.. (sorry for the cliche, and I have greatest respect for & have some great Taxi driver friends who had to study 3-5years of "the knowledge" to become a black cab driver)

Most of the present 'market' is about NEWS (real or created!) that drives short term & volatility, noises drown out real focus of investors' investing strategy.. that is what I am thinking what the Prof. is referring to as momentum investing (I got a finance MBA and am still learning on a daily basis from likes of Prof. Aswath)

Companies like this interview above (Bloomberg) is about 'reporting' market changing events (nothing wrong with that) which might or might not affect real 'intrinsic' value of the company but the 'sentiments' which is reflected of the share price which is generally (& rather frequently) bear a life of its own compare to the underlying performance and viability of the company... (as mentioned the 5% down share price of Apple yesterday).

Just listen to the interview again.. the professor was just stating his view.. and that he does not 'understand' momentum investing (which is nothing wrong).

Feel free to do so as you wish, but do not cry to the regulators and friends & family when you lose a big chunk of the investments in the years to come.. as it is not your game, and it is set by others..

##NB: Credentials: Do not forget the professor is the handful of people that "predicted" the DOT COM BUST .. read his book "Dark side of valuation" 2001 http://amzn.to/J9JqHt , and free paper 2000 (pdf download): http://people.stern.nyu.edu/adamodar/pdfiles/papers/HighGrow.pdf

In short, Disregard his comments at your own perils ..

Just look at the shorter term 'momentum' investing and the 'boards' that focus on share price Mostly and please the short term market.. examples of great corporations like GEC/Marconi that had billion of cash.. what happened? say no more.

did a quick search and saw this link to caslon analytics (no relationship with them nor have I come across them before) re dot.com : http://pratclif.com/economy/financial%20crises/dot-com%20-telecom-bubbles.htm

my 1pence worth of comment which will most likely be drowned out... we will see in 3-5years.

BR

@GarethWong

http://GW.CXOVIP.org

Read more: http://www.businessinsider.com/finance-guru-damodaran-dumped-apple-2012-4#comment-4f8ec92beab8ea9946000067#ixzz1sOtwecqH

Thursday, 12 April 2012

Chart of the Day: Bank CEO pay vs share prices in 2011

Chart of the Day: Bank CEO pay vs share prices in 2011:

very interesting piece..

but the companies' profit should also be plotted also.. no?

key is that if these CEOs made the right decision that helps make the company a sustainable success.. why should they not be rewarded!?

I would challenge any of you to do their job (I would welcome the opportunity of course!).. ;-)

very interesting piece..

but the companies' profit should also be plotted also.. no?

key is that if these CEOs made the right decision that helps make the company a sustainable success.. why should they not be rewarded!?

I would challenge any of you to do their job (I would welcome the opportunity of course!).. ;-)

Subscribe to:

Comments (Atom)