Big Idea 2013: Responsible Social Media | LinkedIn:

Agreed, but it has to be "harnessed" for good, rather than bad... less TALK but more "intelligent actions", power must comes with responsibilities.. if Arab spring's only goal was to over throw the government, it was a success, sadly some of my friends reported that the uncertainty and power vacuum now could ultimately be filled with some even more dangerous players/parties... good luck to us all..

not in my words but pls see latest examples:

1) Bad use of social network: Facebook rampage: Schoolgirl's mother facing £30k clean-up on home in Billericay could now face... http://bit.ly/RmMUMr

2) & REALLY good and RIGHT way is to use social media intelligently for finding the best use of it: The New York Times: ‘Putting charities to the test’ http://shar.es/6ND5L via @sharethis

BR

@GarethWong

Wednesday 12 December 2012

Monday 3 December 2012

My short comments re Vanity & Debt & short term incentives; on Must read post by Prof Aswath Damodaran Musings on Markets: Acquisition Archives: Winners and Losers

Hey Prof

very timely piece,

agree with your analysis, I know well quite a few of these top CEOs /Board directors... sadly there maybe other reasons ontop of the pressure of advisers and very sad fact is that at present capital market is about Vanity & Debt & short term incentives

1) Vanity of "being the deal makers" , whether successful or not.. HP& Autonomy = failed but eBay & Skype was a success as Meg managed to offload it Microsoft for a profit!?

2) Debt fueled everything era is still alive and well despite it created millions of zombie firms now worldwide.. should "efficient use of capital" still be equal to debt any longer!??

3) shorterm-ism rules the day now, given spot price changes of share price (don't forget it is market sentiments and not equal to absolute viability of companies) and short term appointments of CEOs (max 3-5years if lucky) and their short term incentives means it makes much more sense for them to make the short term deals as they can get their bonus or options in time before they parachuted or head-hunted out (unless they mess up and get sacked with a golden goodbye)....

plus of course the "market" fueled by likes of CNBC, reuters, bloomberg as volatility for them means better business!! (nothing wrong with that, loads of good friends for me in that sector, but this IS the status quo!!)

Therefore, if you are doing any analysis, I would implore you to take into account for not listed firms and also family dynasties and conglomerates (mostly private now) and we should be able to really understand the real reasons behind all these.. !??

hope I made sense!?

BR

@GarethWong

very timely piece,

agree with your analysis, I know well quite a few of these top CEOs /Board directors... sadly there maybe other reasons ontop of the pressure of advisers and very sad fact is that at present capital market is about Vanity & Debt & short term incentives

1) Vanity of "being the deal makers" , whether successful or not.. HP& Autonomy = failed but eBay & Skype was a success as Meg managed to offload it Microsoft for a profit!?

2) Debt fueled everything era is still alive and well despite it created millions of zombie firms now worldwide.. should "efficient use of capital" still be equal to debt any longer!??

3) shorterm-ism rules the day now, given spot price changes of share price (don't forget it is market sentiments and not equal to absolute viability of companies) and short term appointments of CEOs (max 3-5years if lucky) and their short term incentives means it makes much more sense for them to make the short term deals as they can get their bonus or options in time before they parachuted or head-hunted out (unless they mess up and get sacked with a golden goodbye)....

plus of course the "market" fueled by likes of CNBC, reuters, bloomberg as volatility for them means better business!! (nothing wrong with that, loads of good friends for me in that sector, but this IS the status quo!!)

Therefore, if you are doing any analysis, I would implore you to take into account for not listed firms and also family dynasties and conglomerates (mostly private now) and we should be able to really understand the real reasons behind all these.. !??

hope I made sense!?

BR

@GarethWong

Friday 30 November 2012

Q4 E/MBA Club, pre-screening before UK premier of 3D "Life of Pi" hosted by Cameron Saunders, UK MD 20th Century Fox Theatrical Division, independent report written by Derrick Khan EMBA10

Event report kindly independently written by Derrick Khan (EMBA10), ex Solution Architect with speciality in IT Services design at Dell for 7years & now looking for a role as IT business analyst or enterprise architect. (he was also our photographer for the night!)

++++

Gareth Wong’s (founder E/MBA & Gambond® ) Quarterly E/MBA Club London alumni events (www.CassAlumni.org) are notoriously hard to get an invite to, primarily because in order to attend you must be a fully graduated E/MBA alumnus of City / Cass Business School - it is that makes the club so very special. But with exclusivity taken to new heights some of the 1537 members would have had to entered competitions (indeed some did) to win a place at the very discreet and exclusive 28th E/MBA alumni event.

Rightly so, this was a special event by any standards – a pre-screening of “Life of Pi” in fabulous 3D hosted at the private VIP cinema of 20th Century Fox HQ in Soho Square, London! With seating limited to a cosy 30 attendees, senior business leaders, especially those in media, entertainment & finance were targeted with the modern equivalent of priority golden ticket invites in an all star cast ensemble of importance and reserved exuberance. With the likes of Mr Yuichi Alex Takayama CEO Tokio Marine Securities (EMBA00) flying in from Ireland, expectations were flying high.

Indeed it is worth mentioning at this point that our gracious host Mr Cameron Saunders, Managing Director UK Theatrical at 20th Century Fox UK (EMBA00) went above and beyond the call of duty, not only did Cameron offer superb hospitality and deliver an excellent talk on the economics of the film industry and trends (which I apologise in advance for failing to do justice here in my article) but also kindly over-ran without hesitation on the Q & A despite having a poorly child at home.

With the event kicking off at 18:45pm for light networking over refreshments and drinks, some elevator pitches were often dizzying by most people’s standards but without being grandiose. At this point, I quickly got into role by pulling out a big notepad (the only one from half a dozen that my daughter had not scribbled over, or was pink!) and an SLR camera with which I took great delight in recording the evening.

I would like to thank Mr Gareth Wong for organising this great event and in bringing this special crowd together. On a personal note, Gareth’s conscientious inclusivity in extending the invitation to me with the opportunity to make a contribution as pseudo reporter and photographer is most gratefully appreciated, as well as Gareth’s on-going commitment to the successful E/MBA club.

By 7pm 20 or so guests had arrived. The scene was set within the basement of the 20th Century Fox HQ. A brightly lit and non-ostentatious area contrasted invitingly by a darkly lit and comfy looking theatrical auditorium. There was a palatable sense of excitement and in particular, of anticipation about the coming 3D effects and animations - and for those who were slightly less informed about film, a mind-bending discovery of fantasy awaited. Once photography ground rules had been established, the guests moved effortlessly to the black fabric covered oversized seating. Amusingly, a few (no names starting with ‘G’ will be mentioned ;-) asked which the best seats were – no worries, you should see me when I walk into a 1000 seat cinema, I get struck down with the same cognitive dissonance.

After Gareth briefly thanked the guests and event host Mr Cameron Saunders, Cameron opened with the interesting fact that his first day in role was Jan. 2009, the first day that President Obama was inaugurated. Well, it set the scene because President Obama was elected in 2008 and it was this year that Cameron selected as a baseline to the 2012 comparison of theatrical distribution trends split by box office, revenue, marketing and print. Cameron also spoke about the economics of the theatrical film industry (box office economics).

Comparing a basket of films from 2008 to 2012, some had done better than expected and others not as expected. However, the aggregate variance of a basket of films observed was fairly tight but with individual films exhibiting big variance within a range of returns. For example “Taken” released in 2008 (with a sequel appearing in 2012, “Taken 2”) stood the test of time better than some other films released by Fox in that year (Juno, Jumper, Australia, The Happening, The Day The Earth Stood Still etc.), showing that getting the formula right produces dividends married to longevity. The key here is achieving the right artistic ingredients and theatrical nuances (for want of a better comparison), ensuring the sun and moon alignment are most favourable to that mix at film launch!

In terms of the economics, at 2008 prices, Fox’s cut of a £5 ticket would have been around £1.20 with growth to 2012 coming largely from box office ticket price inflation. But things have been changing structurally with a shift in the global pattern of film consumption driven by a number of factors including technology, piracy and new markets. For example, in Russia a film will be pirated next day after release, so upside from home entertainment is non-existent - significant because a chunk of revenue simply vanishes in that market space.

With other emergent markets, e.g. China and Brazil, the Hollywood model (break even in the US, upside via international) has shifted with the US no longer the dominant consumer versus the international market – huge upside potential. Also, the new market mix has been marked by the changing nature of films to cater for a new predominance of tastes, for example Kung-Fu Panda to some extent developed to cater for the Asian market.

Technology has impacted the industry too. Films can now be consumed via an array of technology outlets. This adds a layer of complexity (and leakage in the aftermarket) while at the film reel end, digital distribution using hard disks to cinema versus shipping huge drums of film has resulted in simplicity. The cost of upgrading the cinema projection systems is being met by a consortium so not instant cost reduction benefit to 21st Century Fox, but once the transformation funding is complete, significant revenue savings will be realised across the board in film print and distribution.

With global box office consumption changing shape, bets are potentially getting bigger. When Disney purchased the rights to the next “Star Wars” for $4.2 billion, it was seen as a bold move – and with global rights including theme parks, toys etc. there is a feeling that it will pay-off. Certainly there is enough in the mix for that to be the case. But with the focused goal of 20th Century Fox to achieve healthy theatrical profit, for them it is not a case of throwing a million dice and seeing which ones land 6. Numbers are much tighter and statistical modelling of success is particularly difficult with a small sample set - compounded by production and promotion budgets not being strong success indicators. The economy and the weather (amongst dozens of other factors) at release can have as significant impact.

This gets us to the crux of the problem (and challenge) outlined by Cameron. How to better predict the box office performance of an individual film? What financial methodologies / modelling would achieve this on small sample sets and fuzzy data? Well, this is the gauntlet laid down by Cameron and should you accept the challenge, you could win two red carpet tickets to the Hitchcock premier on the 9th of December for the best answer (deadline 5th Dec.). So, for your chance to rub shoulders with the likes of Sir Anthony Hopkins and Dame Helen Mirren - do not delay submitting your solutions! Send answers to either Cameron directly or via Gareth Wong (who I’m sure will not pretend they are all his ideas, anyway he will be too busy to go).

So, what happened to Life of Pi? Well following plenty of good questions from the audience we were rewarded with a visual and auditory odyssey of a very different kind. The combination of which created an enjoyable and memorable evening.

The Life of Pi is a remarkable film by the Director Ang Lee. It is based on a fantasy adventure novel by Yann Martel published in 2001. The protagonist, Piscine Molitor "Pi" Patel, an Indian boy from Pondicherry, explores issues of spirituality and practicality from an early age. He survives 227 days after a shipwreck while stranded on a boat in the Pacific Ocean with a Bengal tiger named Richard Parker. The amazing visuals take the viewer on an epic and wonderful journey of adventure and discovery which is both somehow frustrating and rewarding in equal measure. A ground breaking film which may leave your mind wondering for some time after, perhaps to the point where you decide to go see it again – very clever if intended that way and maybe I will.

Thanks again to Cameron for hosting the 28th E/MBA club event at the 20th Century Fox HQ in London. On a commercial basis (which basically translates to the right film at the right price), 20th Century Fox can offer VIP private screenings for corporate hospitality at a number of exclusive venues (I’m told, much swankier than their own facilities). Should any of E/MBA have a requirement for entertainment of high net worth individuals or clients then do contact 20th Century Fox who partner with a corporate hospitality company to organise events such as this, or even secure Premiere tickets for a full red carpet treatment!

++++

Gareth Wong’s (founder E/MBA & Gambond® ) Quarterly E/MBA Club London alumni events (www.CassAlumni.org) are notoriously hard to get an invite to, primarily because in order to attend you must be a fully graduated E/MBA alumnus of City / Cass Business School - it is that makes the club so very special. But with exclusivity taken to new heights some of the 1537 members would have had to entered competitions (indeed some did) to win a place at the very discreet and exclusive 28th E/MBA alumni event.

Rightly so, this was a special event by any standards – a pre-screening of “Life of Pi” in fabulous 3D hosted at the private VIP cinema of 20th Century Fox HQ in Soho Square, London! With seating limited to a cosy 30 attendees, senior business leaders, especially those in media, entertainment & finance were targeted with the modern equivalent of priority golden ticket invites in an all star cast ensemble of importance and reserved exuberance. With the likes of Mr Yuichi Alex Takayama CEO Tokio Marine Securities (EMBA00) flying in from Ireland, expectations were flying high.

Indeed it is worth mentioning at this point that our gracious host Mr Cameron Saunders, Managing Director UK Theatrical at 20th Century Fox UK (EMBA00) went above and beyond the call of duty, not only did Cameron offer superb hospitality and deliver an excellent talk on the economics of the film industry and trends (which I apologise in advance for failing to do justice here in my article) but also kindly over-ran without hesitation on the Q & A despite having a poorly child at home.

With the event kicking off at 18:45pm for light networking over refreshments and drinks, some elevator pitches were often dizzying by most people’s standards but without being grandiose. At this point, I quickly got into role by pulling out a big notepad (the only one from half a dozen that my daughter had not scribbled over, or was pink!) and an SLR camera with which I took great delight in recording the evening.

I would like to thank Mr Gareth Wong for organising this great event and in bringing this special crowd together. On a personal note, Gareth’s conscientious inclusivity in extending the invitation to me with the opportunity to make a contribution as pseudo reporter and photographer is most gratefully appreciated, as well as Gareth’s on-going commitment to the successful E/MBA club.

By 7pm 20 or so guests had arrived. The scene was set within the basement of the 20th Century Fox HQ. A brightly lit and non-ostentatious area contrasted invitingly by a darkly lit and comfy looking theatrical auditorium. There was a palatable sense of excitement and in particular, of anticipation about the coming 3D effects and animations - and for those who were slightly less informed about film, a mind-bending discovery of fantasy awaited. Once photography ground rules had been established, the guests moved effortlessly to the black fabric covered oversized seating. Amusingly, a few (no names starting with ‘G’ will be mentioned ;-) asked which the best seats were – no worries, you should see me when I walk into a 1000 seat cinema, I get struck down with the same cognitive dissonance.

After Gareth briefly thanked the guests and event host Mr Cameron Saunders, Cameron opened with the interesting fact that his first day in role was Jan. 2009, the first day that President Obama was inaugurated. Well, it set the scene because President Obama was elected in 2008 and it was this year that Cameron selected as a baseline to the 2012 comparison of theatrical distribution trends split by box office, revenue, marketing and print. Cameron also spoke about the economics of the theatrical film industry (box office economics).

Comparing a basket of films from 2008 to 2012, some had done better than expected and others not as expected. However, the aggregate variance of a basket of films observed was fairly tight but with individual films exhibiting big variance within a range of returns. For example “Taken” released in 2008 (with a sequel appearing in 2012, “Taken 2”) stood the test of time better than some other films released by Fox in that year (Juno, Jumper, Australia, The Happening, The Day The Earth Stood Still etc.), showing that getting the formula right produces dividends married to longevity. The key here is achieving the right artistic ingredients and theatrical nuances (for want of a better comparison), ensuring the sun and moon alignment are most favourable to that mix at film launch!

In terms of the economics, at 2008 prices, Fox’s cut of a £5 ticket would have been around £1.20 with growth to 2012 coming largely from box office ticket price inflation. But things have been changing structurally with a shift in the global pattern of film consumption driven by a number of factors including technology, piracy and new markets. For example, in Russia a film will be pirated next day after release, so upside from home entertainment is non-existent - significant because a chunk of revenue simply vanishes in that market space.

With other emergent markets, e.g. China and Brazil, the Hollywood model (break even in the US, upside via international) has shifted with the US no longer the dominant consumer versus the international market – huge upside potential. Also, the new market mix has been marked by the changing nature of films to cater for a new predominance of tastes, for example Kung-Fu Panda to some extent developed to cater for the Asian market.

Technology has impacted the industry too. Films can now be consumed via an array of technology outlets. This adds a layer of complexity (and leakage in the aftermarket) while at the film reel end, digital distribution using hard disks to cinema versus shipping huge drums of film has resulted in simplicity. The cost of upgrading the cinema projection systems is being met by a consortium so not instant cost reduction benefit to 21st Century Fox, but once the transformation funding is complete, significant revenue savings will be realised across the board in film print and distribution.

With global box office consumption changing shape, bets are potentially getting bigger. When Disney purchased the rights to the next “Star Wars” for $4.2 billion, it was seen as a bold move – and with global rights including theme parks, toys etc. there is a feeling that it will pay-off. Certainly there is enough in the mix for that to be the case. But with the focused goal of 20th Century Fox to achieve healthy theatrical profit, for them it is not a case of throwing a million dice and seeing which ones land 6. Numbers are much tighter and statistical modelling of success is particularly difficult with a small sample set - compounded by production and promotion budgets not being strong success indicators. The economy and the weather (amongst dozens of other factors) at release can have as significant impact.

This gets us to the crux of the problem (and challenge) outlined by Cameron. How to better predict the box office performance of an individual film? What financial methodologies / modelling would achieve this on small sample sets and fuzzy data? Well, this is the gauntlet laid down by Cameron and should you accept the challenge, you could win two red carpet tickets to the Hitchcock premier on the 9th of December for the best answer (deadline 5th Dec.). So, for your chance to rub shoulders with the likes of Sir Anthony Hopkins and Dame Helen Mirren - do not delay submitting your solutions! Send answers to either Cameron directly or via Gareth Wong (who I’m sure will not pretend they are all his ideas, anyway he will be too busy to go).

So, what happened to Life of Pi? Well following plenty of good questions from the audience we were rewarded with a visual and auditory odyssey of a very different kind. The combination of which created an enjoyable and memorable evening.

The Life of Pi is a remarkable film by the Director Ang Lee. It is based on a fantasy adventure novel by Yann Martel published in 2001. The protagonist, Piscine Molitor "Pi" Patel, an Indian boy from Pondicherry, explores issues of spirituality and practicality from an early age. He survives 227 days after a shipwreck while stranded on a boat in the Pacific Ocean with a Bengal tiger named Richard Parker. The amazing visuals take the viewer on an epic and wonderful journey of adventure and discovery which is both somehow frustrating and rewarding in equal measure. A ground breaking film which may leave your mind wondering for some time after, perhaps to the point where you decide to go see it again – very clever if intended that way and maybe I will.

Thanks again to Cameron for hosting the 28th E/MBA club event at the 20th Century Fox HQ in London. On a commercial basis (which basically translates to the right film at the right price), 20th Century Fox can offer VIP private screenings for corporate hospitality at a number of exclusive venues (I’m told, much swankier than their own facilities). Should any of E/MBA have a requirement for entertainment of high net worth individuals or clients then do contact 20th Century Fox who partner with a corporate hospitality company to organise events such as this, or even secure Premiere tickets for a full red carpet treatment!

Tuesday 27 November 2012

We must learn how to communicate and promote positive messages... good example is this video Dumb Ways to Die - YouTube

Dumb Ways to Die - YouTube:

We must learn how to communicate and promote positive messages... good example is this video

surely we can do more!?

more explaination by John the creator at McCann Worldwide Auz:

We must learn how to communicate and promote positive messages... good example is this video

surely we can do more!?

more explaination by John the creator at McCann Worldwide Auz:

Tuesday 9 October 2012

My thoughts? sure but must be regulated due to danger!? UK nitrogen cocktail drinker has stomach removed - chicagotribune.com

UK nitrogen cocktail drinker has stomach removed - chicagotribune.com:

Its all great to do all these fusion etc. but bodged fusion means REAL danger

something must be done to prevent future stomach removals and lost of lives!!!

Its all great to do all these fusion etc. but bodged fusion means REAL danger

something must be done to prevent future stomach removals and lost of lives!!!

Friday 5 October 2012

popularism ruined like adding acid to orange juice... The British: how insularity and the weather shaped our national identity - Telegraph

The British: how insularity and the weather shaped our national identity - Telegraph:

IMHO the interjection of comments and insights from non historians like actors/actresses/ even comediens totally ruin the trustworthiness and opportunity of this series has for the younger generation.

IMHO the interjection of comments and insights from non historians like actors/actresses/ even comediens totally ruin the trustworthiness and opportunity of this series has for the younger generation.

Wednesday 3 October 2012

my comments & predictions re Call for European banks to separate retail and investment | The Times

Call for European banks to separate retail and investment | The Times:

This all make perfect sense and logical.

fact of the matter is, which regulator would be strong and daring enough to implement this suggestions and with real enforcement power....

and whether the real power, namely firms with money and global reach would listen and comply? as it is to be frank rather easy to move jurisdictions... since most regulators would be influenced by politics; most therefore would not dare to take drastic rules that might annoy the paymasters ...

we can see what happens with Hollande in France

The real issue and challenges is that the capital and finance market is now sadly structurally favoured short term; nothing wrong with it as long as you are hedgefunds or traders... personally I would love to have the cash flow rich, cash generative conglomerates back.. likewise we cannot blame the banks as they are like herds as mostly main market listed and therefore they HAD to perform and can you blame the bulldog that bite your hand when you have trained it to fight like an animal??

therefore this suggestions although make perfect sense, mark my words, we will be talking about the same thing on 3rd Oct. 2013 as sadly, IMHO the capital market has stayed the same doing what it was doing back in 2008 maybe with same people in different seats.

Sad but true!?

@GarethWong

This all make perfect sense and logical.

fact of the matter is, which regulator would be strong and daring enough to implement this suggestions and with real enforcement power....

and whether the real power, namely firms with money and global reach would listen and comply? as it is to be frank rather easy to move jurisdictions... since most regulators would be influenced by politics; most therefore would not dare to take drastic rules that might annoy the paymasters ...

we can see what happens with Hollande in France

The real issue and challenges is that the capital and finance market is now sadly structurally favoured short term; nothing wrong with it as long as you are hedgefunds or traders... personally I would love to have the cash flow rich, cash generative conglomerates back.. likewise we cannot blame the banks as they are like herds as mostly main market listed and therefore they HAD to perform and can you blame the bulldog that bite your hand when you have trained it to fight like an animal??

therefore this suggestions although make perfect sense, mark my words, we will be talking about the same thing on 3rd Oct. 2013 as sadly, IMHO the capital market has stayed the same doing what it was doing back in 2008 maybe with same people in different seats.

Sad but true!?

@GarethWong

Tuesday 2 October 2012

short comments re Tech City under threat from twin rival projects - Telegraph

Tech City under threat from twin rival projects - Telegraph:

surely more initiatives are better?

surely more initiatives are better?

FinTech space is indeed ripe for B2B & B2C opportunities but hope new firms will create new industries that hire many rather than being stuck in the startup handful of people phase.

good luck to Eric & indeed us all.

Saturday 25 August 2012

@GarethWong 's comments re @AswathDamodaran 's Musings on Markets: Groupon Gloom: Deal of the day or Death Spiral?

Musings on Markets: Groupon Gloom: Deal of the day or Death Spiral?:

" In Groupon's case, where the business model was clearer at the time of the IPO, the business model has collapsed and it is difficult to see what the company can do to set itself apart from the competition and make money at the same time."

" In Groupon's case, where the business model was clearer at the time of the IPO, the business model has collapsed and it is difficult to see what the company can do to set itself apart from the competition and make money at the same time."

Totally respect the methodological & thoroughness of Prof's work on the valuation.. it just shows I still have much to learn! ;-)

If we bring our mind back however to definition of fundamental of business, which is the products/services and business model etc.. we could have foreseen that this could be a big waste of everyone's time & effort AND money..

as a nobody like me already said the business model was 'not broken' but "not sustainable" ever since it launched and first blogged about it back in 2010 and predicted them will not exist by 2015.. ( My response & prediction peHUB Depressing Thoughts About Groupon’s Model http://bit.ly/T8jyMf ), seems like I was wrong, their end might arrive sooner than that.. ;(

there is a fundamental structural & supply problems of the capital market, which is the smoke screen & quality and timeliness of the business critical information.. we need a solution..

Friday 24 August 2012

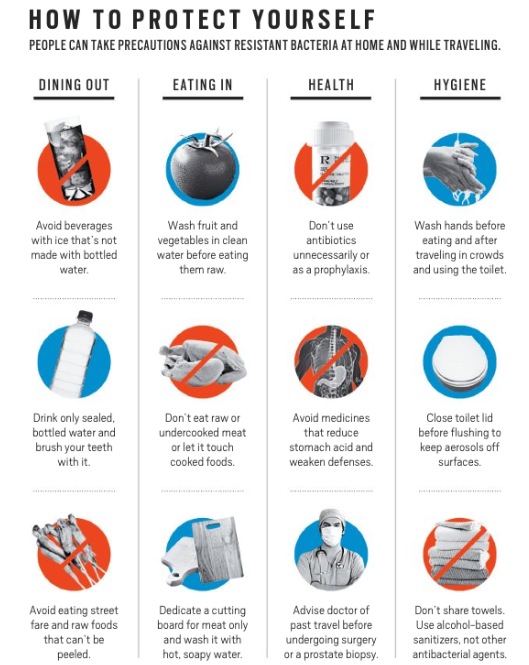

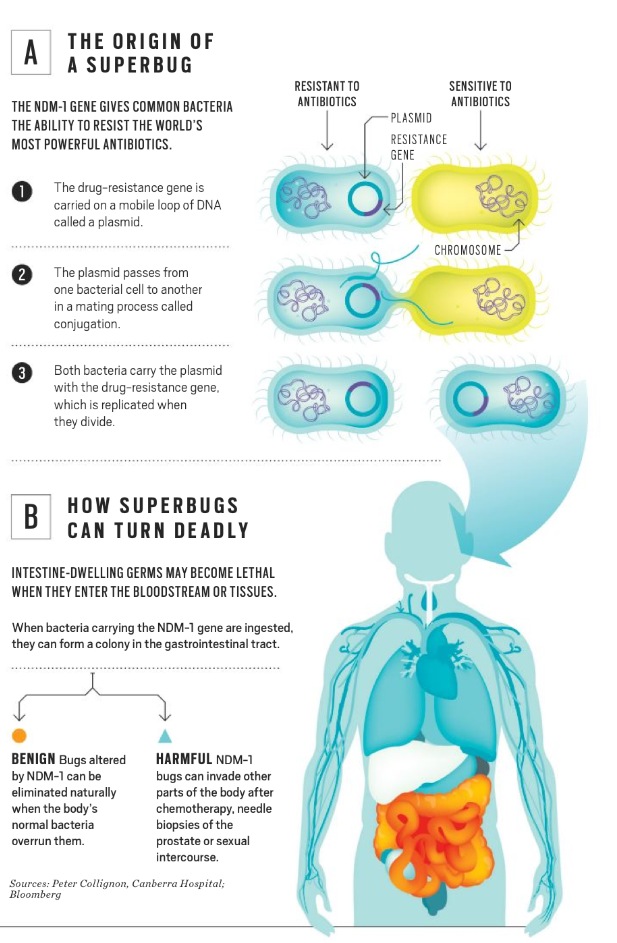

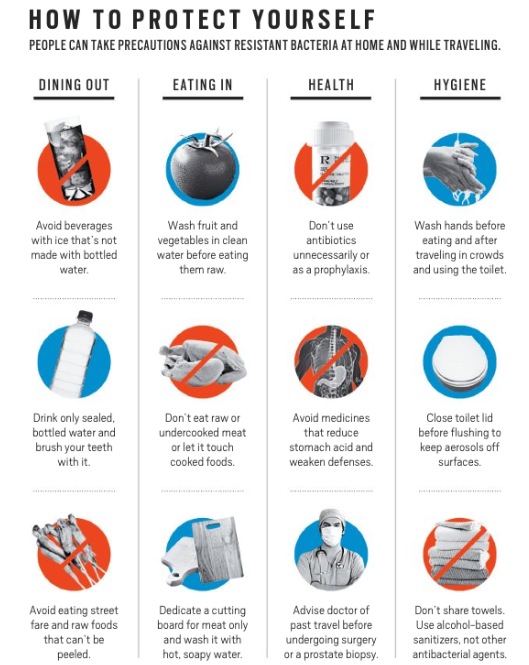

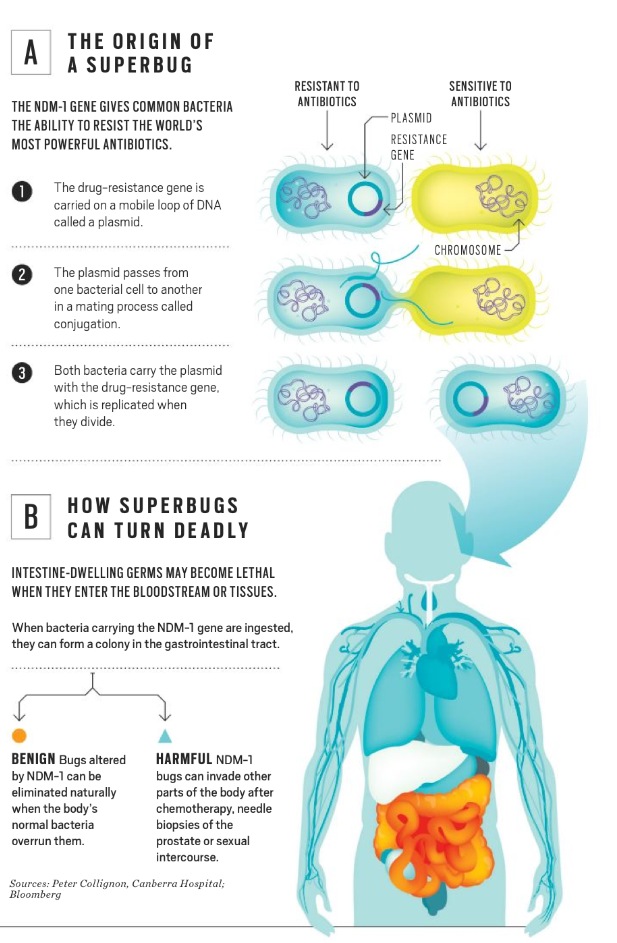

Must READ &Understand.. re The Super-Bug: Antibiotic Resistant and Killing Thousands

The Super-Bug: Antibiotic Resistant and Killing Thousands:

Must read..

if at least look at the infographs below on how to protect yourself and origin of the super bugs..

Sadly this is like the discussion re 'vaccinations'.. personal or national decisions may have much wider and lasting consequences!! Real hidden danger!

Must read..

if at least look at the infographs below on how to protect yourself and origin of the super bugs..

- more details also on: More Drugs Mean More Disease As China Fails To Control Use Of Antibiotics Oct.2011 Bloomberg

- also on Why antibiotics are losing the war against bacteria Telegraph Jul.2012

- AND: Asian Contagion asia360news.com Jul.2012

- @ajenglish The hidden costs of overprescribing drugs AlJazeera English 24Aug 2012

Sadly this is like the discussion re 'vaccinations'.. personal or national decisions may have much wider and lasting consequences!! Real hidden danger!

Steve Jobs Begs Designers in 1983 to Build Better Looking Computers

Steve Jobs Begs Designers in 1983 to Build Better Looking Computers:

Wow, must listen.. his style, vision & confidence..

he described google street view etc!

click through above link to read more.

Wow, must listen.. his style, vision & confidence..

he described google street view etc!

click through above link to read more.

Thursday 2 August 2012

Wednesday 1 August 2012

Why gold is not gold, and bronze is worth less than a petrol station sandwich | London Spy - Yahoo! Eurosport UK

Why gold is not gold, and bronze is worth less than a petrol station sandwich | London Spy - Yahoo! Eurosport UK:

Interesting read.. money can't buy the £3 worth of the Bronze medal. ;-)

"But the bronze medals - including the one won by Rebecca Adlington in the 400m freestyle on Sunday night - are worth less than £3.

The gold medals, ironically, are barely gold at all: they are, in fact, 92.5 per cent silver, with just one per cent gold and the rest copper. Their basic value is £410.

"

Interesting read.. money can't buy the £3 worth of the Bronze medal. ;-)

"But the bronze medals - including the one won by Rebecca Adlington in the 400m freestyle on Sunday night - are worth less than £3.

The gold medals, ironically, are barely gold at all: they are, in fact, 92.5 per cent silver, with just one per cent gold and the rest copper. Their basic value is £410.

"

Friday 27 July 2012

Tuesday 17 July 2012

My 3 points suggestions 4 @MarissaMayer as new Yahoo CEO, hires Google’s Marissa Mayer as its CEO | Firstpost

Yahoo hires Google’s Marissa Mayer as its CEO | Firstpost:

Well, it will be a big challenge, as she will lead 'as an outsider' on a military jet plane with jittery board who might have trigger happy fingers on her seat's eject button...

Well, it will be a big challenge, as she will lead 'as an outsider' on a military jet plane with jittery board who might have trigger happy fingers on her seat's eject button...

plus internal politics and pressure in creating 'new vision' to consolidate now perceived disparate yahoo... turnaround is a different Kattle of fish.

good thing is that seems like Marissa has a loving family and now as millionaire, she can stay true to her new vision for Yahoo and thus has a bullet proof parachute whether got ejected immaturely or not..

my suggestion? she need to be in it to win it, turnaround take time, probably 2-5years if not longer.. she therefore need time, and given the quarterly earnings pressure etc. it would be very difficult to implement and see results (except cost cutting which sadly is not good for long term future of company except cutting dead woods), therefore, my suggestions would be:

1.) buy time, if it is cheap enough, and she is bold enough, take Yahoo private, (share price at all time low!?), with hopefully a decent war chest for acquisition that supports the medium to long term vision created (next point).

2.) devise a medium & long term vision that has all the internal stake holders buy-in, and work towards that, and using her strength of products/design, and focus on what customers might not what they wanted in the first place... Yahoo is strong in rated pages (passed sell by date?) and even pictures (flickr) and even groups... thus, need a 'new ground'

3.) find a new ground that not any of the majors have a stake in vs facebook, google, microsoft.. seems to me secure enterprise could be one (google is trying the 'cloud' enterprise from scratch), maybe its time to buy & merge in some best in clase enterprise companies like blackberry?? (I trust Thorsten would not listen to my previous suggestions http://t.co/1K4UnFj . Yes, it would be easy picking if Blackberry is not under strong management! )

Good luck with new job & new baby, good that Marissa is a lady, otherwise, there will be new mistress soon..

Joking aside, glad that most likely all my flickr photos & yahoo groups are now in 'safer hands'. ;-)

garethwong

Monday 16 July 2012

my blog re challenges/danger, opportunities & responsibilities regarding Ralph's comment re Social gaming | Ralph Topping - William Hill CEO

Ralph, it’s very brave & right of you to take this stance, which I would also agree with & totally support & hope others would follow (no doubt your comments are targeting both the City & wider audience interested in the gaming world). I’ve been a stern supporter of GamCare (www.GamCare.org.uk) since I started looking at the industry back in 2002 (for Camelot), who has one of the best code of conduct of the gambling industry we have seen worldwide (Ralph & WillHill has been a strong supporter/donor for Responsible Gambling Trust, but not on this years's list, yet..!? ) Therefore, no doubt this comment from Ralph is a very informed & considered one.

Raf's view is also valid as internet is evolving and in fact regulation might not help really given the speed it changes! And to be honest, there is already much ‘self-regulations’ within the internet world (there might be ‘self-imposed’ “eco-system” rules, like facebook, google, android, iTune, in terms of what can be promoted and developed etc.) However, we have seen how easily such rules can be changed based on public opinion or political pressure!

The reality is that like remote gaming/gambling 10-15years back, it was so new that people had no clue the likely effect the new category may have on

1.) Games design (proposition, what they might like/prefer etc. would customers even like it!)

2.) target audience (likely take up, behaviour, habit etc.) nor

3.) whether it would cannibalise their original offline businesses..

All those worry were unfounded, as we have since seen many multi-billion turnover operators.. but this iGaming industry is unique, with typical CPA as high as £100-£160 means that based on supply & demand, some might argue that such high cost was due to combination of high competitions and too many providers vs availability of gambling friendly target audiences. Therefore, if either of these are true, then the arrival and availability of new ‘social-gaming’ would thus be very attractive indeed!

One thing is for sure, that based on hard research, like UK prevalence studies, 2010, 2000 (on UK market, which some may say the most gambling friendly jurisdiction), shows that the amount of people that gamble has only grown limited (in 2010, around 75% but including mostly national lottery), and the number of people that suffer from 'problem' gambling is only less than 1% (of 62m residence in UK) and that is with great works of GamCare (gambleaware.org ) etc... with certifying on and offline casino gaming gambling operators.. however, given likes of Facebook now claiming to be now 900million users predicted to get to billion, if we have 0.01% of them that might be susceptible for problem ‘gaming’, this will indeed be a major worldwide challenge!

Therefore, as Ralph pointed out, if we suddenly use same products (for fun or for fee and/or something in between) and now target much wider audience, given the likely small minority of ‘problem gamers’, the number of people that might have problems could expand exponentially… !!!

Raf is right in saying that self-regulation works, which of course it would, if all are VC funded AND have a conscience and has a dedicated career like Raf for games & gaming… but sadly without regulations or at least some common ‘world’ standard to protect the potentially vulnerable, the potential return is just too attractive for unscrupulous operators in the wild wide west of internet.. thankfully we are talking about small amounts I hear Raf and others saying.. agreed but thankfully people talk (but maybe not enough in sometime) as in a marketing conference just couple of weeks back, a dad told me he had to punish his daughter as she lost (well paid £191.00) on iPhone’s app by buying accessories (not gambling app!)…

Same is therefore true for even non gaming application providers, thus, even Raf is doing the right thing means that others would still exploit the opportunities!

Regulations is the way to go I would hear Ralf and Jenny say, Gambling act 2005 is a world class legislation, sadly due to tax and other reasons we may have operations of major brands based here (some historic or offline reasons) but sadly now given the deregulations of US (!), rest of Europe, present & future gaming/ gambling operators have so many jurisdictional options to choose from that sadly even if UK lead from the front does means potentially unscrupulous operators could still claims they have a ‘license’.. what does the adults/teens of Indonesian or China, French or Spain knows the difference license from UK, Alderney to Antigua, or First Cagayan? Would they do a full research, especially for leisure pounds of social gaming to check the jurisdictional landscape!? Its great that the jurisdictions are working together in their working group towards common standard, but intrinsic nature of the market is that there will for sure be varying level of regulations..and the regulations could easily be changed, and domicile companies could also easily migrate in weeks.. remember the mass exodus of a jurisdiction (won’t name names) a few years back?

This is very close to heart of my company GamBond®’s ethos which is about bringing Global Trust & Confidence for any remotely trading industries (gaming included, but also any financial services from pension to banking)

Therefore, yes, regulation by all means, but industry self regulations would also need to be done, but real key is having the right products AND due to potential addictions problems (yes I am mentioning this!) It is paramount to put in the right process and monitoring to ensure the potentially vulnerable is protected like the industry leaders like Ralph is doing. Do refer to the GamCare code of conducts. You may say, that’s my personal opinion, Ralph, Jenny & I are not alone. See:

I quote below from an ‘games’ industry article that analysed reason for success of Zynga, from games industry website: Gamasutra, in the author’s own words:

“Zynga proudly states that they are an “an analytics company masquerading as a games company”. We see this a bit differently: Zynga is a gambling company masquerading as a new form of games company – and a wildly successful one at that. Their ability to leverage gambling mechanics has earned them over 200 million monthly active users, almost $1 billion in revenue in 2011, and a potential $15-20 billion valuation in their pending IPO.”

Ralph is definitely right, just see the final paragraph of the article:

“No matter the volume of Zynga Poker chips a player earns, or FarmVille resources a player accumulates, their real money has been exchanged for virtual currency, just like an other cash-for-goods transaction. The biggest thing that unequivocally separates social gaming from gambling is that the players have no ability to tangibly recoup the money put into the game. By giving players the ability to win back their investment of time and money in real-money rewards, that would quite literally be a game changer.”

Having had a search though, the author works for a converged gambling enabling platform provider for non gaming developers, which make sense given where he comes from.

Of course, a ‘well accepted’ non gambling market like Japan is a good ‘mirror’ of this situation, where players play Pachiko machines using balls, but the balls are supposed to be exchanged for gifts, right?

This however highlights that we really do need to address “the responsible social gaming” & regulation aspect (ideally on a co-ordinated worldwide basis), and help

1.) future users understand the differences

2.) operators to instil business processes to monitor and

3.) platform providers develop tools to help users and operators to prevent any potential financial & reputational tragedies (not only for individual operators but for the newly converged social gaming vertical)..

4.) Ultimately, enable individual players to monitor/limit their play on a pan industry level (good aim to have)

This is not scaremongering, but has already happened, we don’t need to look far, for non UK reader, you might not be aware of another converged ‘gaming’ opportunity back in 2006-2008.. namely “Call-in TV” [using technology from the multi-million/billion of premium rate sector (premium rate phone lines & premium rate SMS)]. There was also call for regulation; sadly it did not happen before the whole future of the industry collapsed, see this guardian piece of calling for regulation.

We had seen the launch, promised potential success and close down of ITV Play in just one year (the aftermath reputational challenge for the ITV brand was probably even worst!)… see ITV Play (wiki), result of the closing down of ITV Play (Guardian).

Therefore, I personally think Ralph is doing the right & honourable thing, no doubt Jenny & the gambling commission will doing the right thing also (although she can't be too strict & scared the present & future licensees' off!?) , challenge is hope other world leading regulators and gaming companies will follow suit.

Definitely must read piece from Ralph, do click through above link to read the full article, if you are too busy, below is the last paragraph, essence:

"So there you have it. The leading British gambling company has chosen to forgo a potentially lucrative business opportunity until appropriate regulation is in place. Why? Because we take the Gambling Act and our social responsibilities very seriously. We are well regulated and we have no problem with that. You can’t gamble in our Retail estate or on our websites unless you are over 18 and we have stringent policies in place to make this happen. I would certainly hope that John Penrose as the Minister charged with responsibility for protecting the vulnerable and Jenny Williams the CEO of the Gambling Commission are as resolute as we are at William Hill.

"

Why Millennials Don't Want To Buy Stuff | Fast Company

Why Millennials Don't Want To Buy Stuff | Fast Company:

Well worth the read but below is KEY!

"3. People buy things because of what having it says about them. This is what The Atlantic author mentions when he talks about the desire of Millennials to live in urban settings. Though I don’t pretend to speak for everyone in my generation, for me this choice has almost nothing to do with being anti-car. Instead, it's about all the other things a "non-car life" represents: it helps me be more environmentally conscious, socially aware, and local. This distinction of purpose may seem nuanced, but motivation is a powerful differentiator (perhaps one of the most powerful).

WHAT TO DO: Connect people to something bigger than themselves through your product or service. A bigger impact is almost always there, we just tend to forget about it.

As we watch the old definition of "ownership" go extinct, how will you leverage the unique connections your product or service could create? It could very well mean the difference between life and death for your business."

Well worth the read but below is KEY!

"3. People buy things because of what having it says about them. This is what The Atlantic author mentions when he talks about the desire of Millennials to live in urban settings. Though I don’t pretend to speak for everyone in my generation, for me this choice has almost nothing to do with being anti-car. Instead, it's about all the other things a "non-car life" represents: it helps me be more environmentally conscious, socially aware, and local. This distinction of purpose may seem nuanced, but motivation is a powerful differentiator (perhaps one of the most powerful).

WHAT TO DO: Connect people to something bigger than themselves through your product or service. A bigger impact is almost always there, we just tend to forget about it.

As we watch the old definition of "ownership" go extinct, how will you leverage the unique connections your product or service could create? It could very well mean the difference between life and death for your business."

Saturday 14 July 2012

my short thoughts on Restrictions on cross-border casino advertising are not prohibited under EU law - Articles - Olswang LLP

Restrictions on cross-border casino advertising are not prohibited under EU law - Articles - Olswang LLP:

Like any cross boarder industries, only a worldwide harmonised rules would work.. as otherwise, it would be either

1) compliance for some and

2) lets find the best loophole for some..

3) or combination of the two..

however there is no escaping a universal fact: "No one country can legislate for the world" and therefore, sadly this will be the status quo going forward for the future unless there is some catalyst for change, to bring some #common standards and measurements..

Only when there is a common benchmark, would industry players can compete fairly and thus can focus efforts on creating new and better products and also adopting best practices to protect consumers, like responsible gaming and supporting charities like GamCare etc.

"The ruling highlights once again the fragmentation of EU Member States' approach to gambling regulation and is a reminder that while outright protectionism will not be tolerated, there is still room for some Member States to take a more zealous approach than others. Reacting to yesterday's judgment, the European Gaming and Betting Association is reported as stating that the ruling "confirms that Member States cannot regulate the gambling market in isolation but need to take into account protection guaranteed by other Member States". With Michel Barnier's recent commitment to pursue Member States whose gambling legislation infringes EU law and the upcoming publication of the European Commission's gambling action plan (see our recent update for further detail), we will wait and see whether this judgment has any impact on the future harmonisation, or divergence, of EU gaming regulations.

"

'via Blog this'

Like any cross boarder industries, only a worldwide harmonised rules would work.. as otherwise, it would be either

1) compliance for some and

2) lets find the best loophole for some..

3) or combination of the two..

however there is no escaping a universal fact: "No one country can legislate for the world" and therefore, sadly this will be the status quo going forward for the future unless there is some catalyst for change, to bring some #common standards and measurements..

Only when there is a common benchmark, would industry players can compete fairly and thus can focus efforts on creating new and better products and also adopting best practices to protect consumers, like responsible gaming and supporting charities like GamCare etc.

"The ruling highlights once again the fragmentation of EU Member States' approach to gambling regulation and is a reminder that while outright protectionism will not be tolerated, there is still room for some Member States to take a more zealous approach than others. Reacting to yesterday's judgment, the European Gaming and Betting Association is reported as stating that the ruling "confirms that Member States cannot regulate the gambling market in isolation but need to take into account protection guaranteed by other Member States". With Michel Barnier's recent commitment to pursue Member States whose gambling legislation infringes EU law and the upcoming publication of the European Commission's gambling action plan (see our recent update for further detail), we will wait and see whether this judgment has any impact on the future harmonisation, or divergence, of EU gaming regulations.

"

'via Blog this'

Thursday 12 July 2012

must watch, still same after 3years! "Bacon as a Weapon of Mass Destruction"

"Bacon as a Weapon of Mass Destruction":

its incredible indeed... 3years now and nothing has changed!

Or listening to NPR interview of Dr. David Kessler, former Commissioner FDA.

its incredible indeed... 3years now and nothing has changed!

Or listening to NPR interview of Dr. David Kessler, former Commissioner FDA.

Friday 6 July 2012

My revised suggestion short blog for Thorsten CEO & Frank CMO of RIM, Saving RIM in Three Easy Steps | Mobile Industry Review

Saving RIM in Three Easy Steps | Mobile Industry Review:

I would agree totally with points 2 and 3 as previously tweeted before

I would agree totally with points 2 and 3 as previously tweeted before

however, I would change number 1 to something different, which will enable 2 & 3 and more, which is:

1.) Take RIM private by a 'strong business leader' (as a second option with present CEO & board with some strong visionary to support and lead them strategically)

this will:

a.) give them time to sort itself out without the demand of public market shareholders, lets be frank, share price and market cap does not necessary equates to viability of company, but mostly short term 'sentiments' of it..

b.) as it is a cash flow rich company, with good IP, good contracts and revenue streams directly with MNOs/MVNOs and enterprise distributors, after cost cutting, and bringing it private, it should have enough time to review.. yes, focus on 2. & 3. but review the proposed 1. maybe getting rid of H/W but there are many ways to skin a cat..

I have been saying a long while (yes, I emailed unsolicited advice to Thorsten).. Sadly appointing bankers would only do one thing, which is advising how to break up the company and sell as it is obvious and easy thing to do (& profitable for all, except the real stake holders of RIM, namely devoted users like myself!).. they would not have advised him to keep his nerves, take on the responsibility, risking personal reputation and future jobs and take the company private and try to rescue it.

It is very stupid to fight the fight of APPLE in the game it created called the iPlayground.. RIM should stick to what it does best, does it 10x and 100x better and let others emulate them. it will take a year or so but being private, it can have enough time to do so!

Definitely do:

I.) looking at productising AND improving reliability of BBM which some might argue it is RIM's crown jewel..

II.) definitely emulate the success of app store, but focus on security, quality and efficiency of the apps, as I see the size of the apps typically goes up exponentially which is stupid (may have technical reason and it could be RIM's platform's fault!? or lack of good application developers!?)

III.) marketing need to be much more savvy.. like in UK, BlackBerry sponsored the whole Sky Atlantic channel.. great, but hey the sky mobile app does not work on blackberry!! surely they could have used deals like this to ensure that there is a coherent marketing strategy..

IV.) or maybe it is really time to cut all marketing and focus 100% on products and services, learn from likes of Zappos & others, Thorsten & Frank should ask Jeff to watch the to be launched movie http://thenakedbrandfilm.com/ it might fire them up.

but all the above is meaningless however, if they are taking the easy way out to break the company and sell them..

It would be a tragedy.. akin to during the dot.com boom when PCCW bought HKTelecoms, no doubt in this case whoever might buy RIM's asset would not be paying as much as PCCW did for HK telecom in 2000.

RIM breaking up and selling is good for the short term, shareholders and easy for the management but from stake holders (like me, loyal BlackBerry users) and also in fact the telecom operators' point of view, RIM keeping faith, sorting itself out, and helping the telecom world to fight the upstarts of likes of iParty is key.. RIM's management might find they may have more friends in telecoms world (esp. MNOs/MVNOs) if they can help maintain a viable and equitable revenue sharing with the operators and rest of value chain.. maybe a pan industry open-standard app-store?

some leadership from RIM could in fact save not only themselves but also loyal customers and in fact the telecom tribe (who is more into capital intensive and highly regulated business). Google/Android/Apple will NOT be sharing & paying for data.. just that point will get the MNOs thinking!

I am telecom guy through and through, this should maybe form a warning for other telecom firms.

Happy to hold Thorsten's hand if needed, call me.

Good luck!

@GarethWong

Thursday 5 July 2012

Olympic Games throw light on supplement contamination

Olympic Games throw light on supplement contamination:

key website below to check what supplements are ok:

http://www.informed-sport.com/

key website below to check what supplements are ok:

http://www.informed-sport.com/

Wednesday 4 July 2012

Brilliant insights re e-book publishing and Self-publishing a book: 25 things you need to know | Fully Equipped - CNET Reviews

Self-publishing a book: 25 things you need to know | Fully Equipped - CNET Reviews:

Big thank you to David.

Brilliant article with tonnes of great tips. must read.. also do read this one also re e-book: http://reviews.cnet.com/8301-18438_7-20010547-82/how-to-self-publish-an-ebook/

I learnt most from below but not sure if I can get ISBN for Europe/Asia!? anyone knows?

"11. Buy your own ISBN -- and create your own publishing house.

If you have market aspirations for your book, buy your own ISBN (International Standard Book Number) and create your own publishing company.

(Credit: www.isbn-us.com)

Even if you go with one of the subsidy presses for convenience's sake, there's no reason to have Lulu, CreateSpace, iUniverse, Xlibris, Author House, Outskirts, or whomever listed as your publisher. For around $100 (what a single ISBN costs) and a little added paperwork, you can go toe-to-toe with any small publisher. Lulu.com sells ISBNs, other self-publishing companies don't. The complete list of sellers is here.

Note: Most self-publishing operations will provide you with a free ISBN for both your print book and e-book but whatever operation provides you with the ISBN will be listed as the publisher."

Fascinating to see Mark's presentation:

Big thank you to David.

Brilliant article with tonnes of great tips. must read.. also do read this one also re e-book: http://reviews.cnet.com/8301-18438_7-20010547-82/how-to-self-publish-an-ebook/

I learnt most from below but not sure if I can get ISBN for Europe/Asia!? anyone knows?

"11. Buy your own ISBN -- and create your own publishing house.

If you have market aspirations for your book, buy your own ISBN (International Standard Book Number) and create your own publishing company.

(Credit: www.isbn-us.com)

Even if you go with one of the subsidy presses for convenience's sake, there's no reason to have Lulu, CreateSpace, iUniverse, Xlibris, Author House, Outskirts, or whomever listed as your publisher. For around $100 (what a single ISBN costs) and a little added paperwork, you can go toe-to-toe with any small publisher. Lulu.com sells ISBNs, other self-publishing companies don't. The complete list of sellers is here.

Note: Most self-publishing operations will provide you with a free ISBN for both your print book and e-book but whatever operation provides you with the ISBN will be listed as the publisher."

Fascinating to see Mark's presentation:

How Data-Driven Decisions *Might* Help Indie Ebook Authors Reach More Readers

View more PowerPoint from Smashwords, Inc.

and don't forget Mark's free book on secret to ebook publishing success: https://www.smashwords.com/books/view/145431

and don't forget Mark's free book on secret to ebook publishing success: https://www.smashwords.com/books/view/145431

Friday 29 June 2012

Definitely true, ;-) comments re Women VCs Rule More Often At China Venture Firms Than In Silicon Valley - Forbes

Women VCs Rule More Often At China Venture Firms Than In Silicon Valley - Forbes:

definitely true!

definitely true!

great article as usual Rebecca

don’t forget Xiangming Fang – Managing Director

MD of AIF Capital

MD of AIF Capital

http://www.aifcapital.com/en/people/Xiangming-Fang/

Tuesday 26 June 2012

very interesting indeed.. whats your conclusion? FT Alphaville » Breaching the AAA bubble, charts du jour

FT Alphaville » Breaching the AAA bubble, charts du jour:

very interesting diagrams..

suggest you click thru or even better, click through to the full report..

thoughts??

"Charts from the BIS 82nd Annual Report. “Sovereigns have been losing their risk-free status at an alarming rate,” the BIS says."

very interesting diagrams..

suggest you click thru or even better, click through to the full report..

thoughts??

"Charts from the BIS 82nd Annual Report. “Sovereigns have been losing their risk-free status at an alarming rate,” the BIS says."

Saturday 23 June 2012

Must read, & my short comments re Bank Investors Dismiss Moody’s Cuts as Years Too Late - Bloomberg

Bank Investors Dismiss Moody’s Cuts as Years Too Late - Bloomberg:

I would suggest you spend that 3 minutes to read through this piece of news...

does this spell end of influence/monopoly of all the rating agencies as an industry? answer is a simple no. there is sadly no alternative.. the comments from Bove below is straight to the point though, is that a common believe??

"Downgrades of Morgan Stanley (MS), Credit Suisse Group AG (CSGN) and 13 other global banks, announced by Moody’s Investors Service after months of speculation about dire fallout, were met instead by rallies in stocks and bonds.

The cost to protect Morgan Stanley’s debt against losses dropped, and the shares rallied as much as 4.6 percent in extended trading yesterday after the ratings firm cut the bank by two levels rather than a threatened three grades. Credit- default swaps tied to Bank of America Corp., which was lowered to within two levels of junk along with Citigroup Inc. (C), also improved, along with those of Goldman Sachs Group Inc. (GS)"

I would suggest you spend that 3 minutes to read through this piece of news...

does this spell end of influence/monopoly of all the rating agencies as an industry? answer is a simple no. there is sadly no alternative.. the comments from Bove below is straight to the point though, is that a common believe??

[‘Forget Moody’s’

“To downgrade a BofA or Citigroup or companies that are sitting on hundreds of billions of dollars of cash in government-backed securities makes no sense,” Richard Bove, an analyst at Rochdale Securities LLC, said in an interview on Bloomberg Radio and Television’s “Bloomberg Surveillance.”

“You can forget Moody’s,” Bove said. “You should have forgotten them a long time ago.”]

"Downgrades of Morgan Stanley (MS), Credit Suisse Group AG (CSGN) and 13 other global banks, announced by Moody’s Investors Service after months of speculation about dire fallout, were met instead by rallies in stocks and bonds.

The cost to protect Morgan Stanley’s debt against losses dropped, and the shares rallied as much as 4.6 percent in extended trading yesterday after the ratings firm cut the bank by two levels rather than a threatened three grades. Credit- default swaps tied to Bank of America Corp., which was lowered to within two levels of junk along with Citigroup Inc. (C), also improved, along with those of Goldman Sachs Group Inc. (GS)"

Thursday 21 June 2012

Brillaint Panel Discussion: Cyber Security Cooperation: Bringing Nations Together. Part 1 - YouTube

Panel Discussion: Cyber Security Cooperation: Bringing Nations Together. Part 1 - YouTube:

brilliant panel.. !

A discussion on cyber warfare and international cooperation as part of Kaspersky Lab's cyber conference "2012: IT Security in the Age of Cyber Warfare".

Senior figures from international government, non-government and law enforcement organizations and Kaspersky Lab discuss the new paradigm of evolving cyber threats and assess how best to control cyber weapons.

Speakers from left to right:

- Alexander Seger, Secretary of the Cybercrime Convention Committee, Head of Data Protection and Cybercrime Division, Council of Europe, Strasbourg, France;

- Alexander Ntoko, Head of Corporate Strategy Division, International Telecommunication Union (ITU);

- Michael Moran, Assistant Director Cybersecurity and Crime, Interpol;

- Richard Stiennon, Chief Research Analyst, IT-Harvest and moderator of the panel discussion;

- Eugene Kaspersky, Chief Executive Officer, Kaspersky Lab.The panelists address the following questions:

- How can cyber war be defined?

- What is the connection between cybercrime and state-backed cyber warfare?

- Which practices have proved to be effective when fighting cybercrime?

- What global strategies should be put in place by public and private organizations to accelerate collaboration and countermeasures against cyber warfare?

brilliant panel.. !

A discussion on cyber warfare and international cooperation as part of Kaspersky Lab's cyber conference "2012: IT Security in the Age of Cyber Warfare".

Senior figures from international government, non-government and law enforcement organizations and Kaspersky Lab discuss the new paradigm of evolving cyber threats and assess how best to control cyber weapons.

Speakers from left to right:

- Alexander Seger, Secretary of the Cybercrime Convention Committee, Head of Data Protection and Cybercrime Division, Council of Europe, Strasbourg, France;

- Alexander Ntoko, Head of Corporate Strategy Division, International Telecommunication Union (ITU);

- Michael Moran, Assistant Director Cybersecurity and Crime, Interpol;

- Richard Stiennon, Chief Research Analyst, IT-Harvest and moderator of the panel discussion;

- Eugene Kaspersky, Chief Executive Officer, Kaspersky Lab.The panelists address the following questions:

- How can cyber war be defined?

- What is the connection between cybercrime and state-backed cyber warfare?

- Which practices have proved to be effective when fighting cybercrime?

- What global strategies should be put in place by public and private organizations to accelerate collaboration and countermeasures against cyber warfare?

Subscribe to:

Posts (Atom)