Redefining capitalism

Despite its ability to generate prosperity, capitalism is under attack. By shaking up our long-held assumptions about how and why the system works, we can improve it.

September 2014 | byEric Beinhocker and Nick HanauerMy comments added to this thread: Network Update Discussion | LinkedIn:

I have also read most of Peter Thiel's book and listen to his talk: I am all for his idea of investing in and creating new monopolies (that fixes things), but surely if his comment that night (I'm paraphrasing here) that he kept 3/4 of his net-worth in Silicon valley as he does not trust the treasury bond bubbles.. read into that! I would have thought with his billions, he could take the plunge and try to fix the treasury bond bubbles!?

Dominic Barton has given many great speeches worldwide . I totally agree with Dominic that we need to focus on fixing energy food and water problems of our world.. (see his speech via his picture above)

Fact of the matter is, there are a lot of talks (not much actions sadly!) about fixing capital market with multitude of "new terminology" from "Inclusive Capitalism" to "Intelligent Governance" etc. sadly no one talks about the fundamental problems, namely (across the board, from companies to governments) too much focus on creating unnecessarily and trading of debt (corporate to personal), glad we have finally the book of #HouseOfDebt by 2Profs Atif Mian and Amir Sufi: #MustListen @GarethWong @BBCRadioCA @peston w @AtifRMian & @profsufi #HouseOfDebt http://t.co/MZ1HNPofhi Cash&Equity

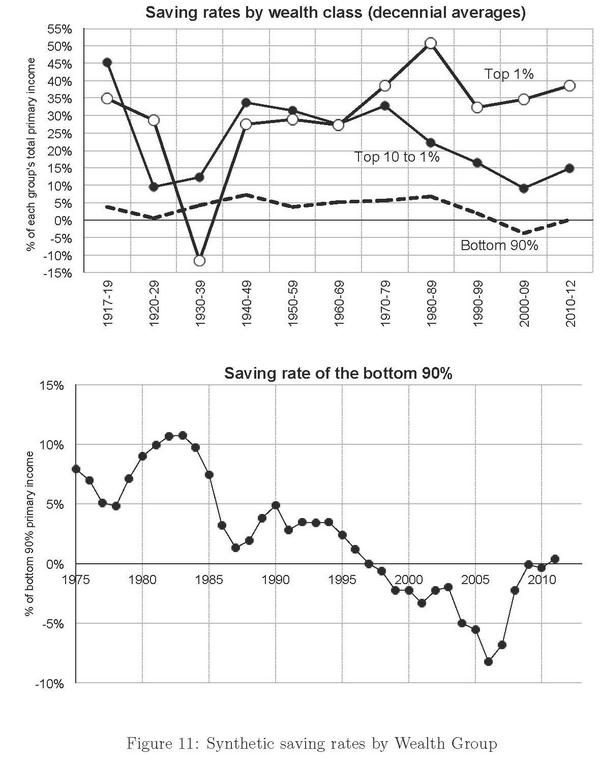

see: Where #HouseofDebt meets wealth inequality: a fabulous chart from Saez and @gabriel_zucman showing saving rates

Our whole world from news to governments are now driven by this endless "Growth at all cost" (as mentioned in the article, GDP is not a good nor ONLY measurement, but we need solution! See Diane Coyle's book @diane1859, summary here on IMF website's "The Price of Everything and the Value of Nothing".), and our world is not rewarding people/firms that make value and punish those that destroy value. CSR AND how we measure/reward the performance data will all need to be redefined.

Even if capital market is fixed (I have not touched on any solution as yet!), if people do not share the a common goal across different verticals, the whole system will still fail! (as it is much easier to have the status quo of "them and us" mindset and make as much money as one can and retire and become tax exile! nothing wrong with that!?)

I propose that we need something more than the CSR. As implementation of CSR is not fundamental enough, not much emotional/dedication/self-less inspired to ensure people/firms are on the same page (share the same goal), therefore, I propose we need a new way of looking at CSR, as explained to Rory before at our lunch, it is called Corporate Parenthood (it is a form of ideology/application of what we know best, family value but applied to business. I need help/constructive feedback though, from Professors to story teller, and even film makers to make it happen & #FixTheWorld).

However, biggest problems for our generation and the the millennial are just engagement with the right thing, they are engaged but sadly with the wrong thing (snapchat!?), how can googlebox be a "thing"? we need to have everyone engaged, but they can only engaged if they challenge themselves.. and sadly me included, not challenged enough! I have solution for that, it is called non profit @Be_Champion Movement (would be great to have some great minds' constructive feedback/help to make it a reality)

That must be the reason why Jean Tirole won his Nobel Prize!

(RT @GarethWong great summary @titonka Understand the research that just won @Jean_Tirole the economics Nobel Prize on Vox via @voxdotcom), we need to measure firms and industry differently, create a new financial ecosystem from ground up.. The solution would be worth a book, or a series of blog post.. not sure if I have time to write it. .. would be great to hear your thoughts.

Talking about Peter Thiel, with is Paypal mafia's help, it would be just lifting the fingers if they wanted to fix the capital market worldwide (OR just capitalism), I would like to challenge them to do so, would they like to accept?

Before they do that though, they must #AskTheRightQuestion! For example, is Cow worst to our environment than Cars?

pls see: RT @cxoasia: @RupertSoskin @creesfoundation @chamiltonjames I referred to "Cow vs Car" which is worst for the environment http://t.co/AE8CBOHyq0 by @davetrott

+#AskRightQ RT @GarethWong http://t.co/SMgyH61WlM in respond to @skottr's post discussing the state of philanthropy in the Silicon Valley. http://t.co/FESj9Ctzcb