Volcker criticises plans for UK banking reforms | Cass Business School:

Neither my experience nor intellect are comparable to those of Mr. Volcker, but there is one question, however ignorant, which I was bursting to ask him. I suspect Dean Richard guessed it, and therefore deliberately passed over me, in favour of a woman from Citi.

My question is this: "Why don’t we get ‘back to basics’, and monitor the present cash flow of the regulated companies?"

All capital ratio and stress tests are based on the markets’ consensus of what they 'might need' to prevent another crisis.

Sadly, however, other than all the regulatory proposal studies and limited retrenchments (which still needed to be sorted out, even at Sovereign debt level), it seems to me that in 2011, we’re back to the pre-credit crunch level of finance merry go-around. That includes banks, whether investment or clearing, pension funds, VC/PE, insurance, re-insurance, hedge funds and alternative risk finance firms.

I am not expert on Basel III either, but once again, if the collective brilliance of human minds can predict and manage risk in a responsible manner (which it mostly manages to until disaster strikes), we would not have near market failure events like the credit crunch, nor even the aftermath of Japan’s earthquakes. As natural diasters ARE intrinsically NOT predictable, creating a set of rules (no matter how brilliant) to second guess the likely capital requirements, or deciding how high to build the coast wall to prevent tsunamis breaking through, are nearly impossible tasks.

Some might argue that I am biased, but this is a critical and fundamental question that needs to be answered.

(Full disclosure: I have spent my last 6/7 years working to create an industry default risk insurance/re-insurance sector. The competitive landscape means that most regulators will have to take into account all stake holders' needs and regulate accordingly, but we should take time out to look for "ANOTHER Way".)

Therefore, surely it is now time to investigate, and invest in, an alternative capital market model that:

1.) Shortens the value chain.

2.) Focuses upon the viability of companies as a whole rather than segregating and securitising chunks of companies or operations when, as we know, even the companies themselves do not know how events might unfold.

I am a very boring, stupid person, who doesn't own stocks, and more to the point, doesn't really understand the price of instruments that typically have no relationships with the underlying assets, but purely on counter party demand and supply.

Maybe someone can change my mind. There’s nothing wrong with people buying and selling (though this is not my point), just not when it adversly affects the boring assets I own.

I digress. The event closed with a vote of thanks from very gracious Sir Malcolm Williamson:

====

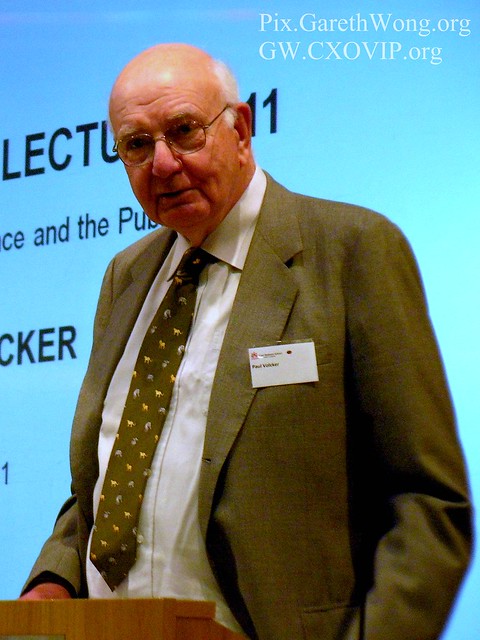

Paul Volcker: "He told a packed audience of students, alumni and City professionals that 'critical details are lacking' in the proposals put forward by the Coalition government's Independent Commission on Banking (ICB).

'The question will inevitably arise as to the financial and regulatory logic of maintaining a 'retail bank' as part of what in most cases would appear a much larger highly diversified and 'systemically significant' organization,' he said.

'In any event, the nagging overriding question will still arise: how to deal with the imminent or actual failure of such a large, systemically significant, financial institution whether or not it is a 'bank'.'

Mr Volcker, who was chairman of President Barack Obama's Economic Recovery Advisory Board until early this year, also said he was concerned by attempts to 'resist new regulatory discipline for fear of impairing the markets'.

He said: 'When we count in the enormous economic losses consequent to the collapse of the financial system, the case for pressing forward with thoroughgoing reform should be uncontested.'"